Your trading advantage

Solutions for energy & commodity trading firms

BroadPeak’s data integration and analytics capabilities are built for energy and commodity trading firms. With global exchange and broker connectivity, and real-time intelligence, BroadPeak simplifies connectivity, enhances transparency, and enables faster, more confident trading, risk, and compliance decisions.

Enterprise solutions for energy & commodity trading firms

BroadPeak delivers the only solution that unifies data from E/CTRMs and exchanges through seamless integrations. Built for speed and reliability, BroadPeak’s feed-agnostic data platform enables trading, analytics, and compliance teams to capture, structure, and deliver enterprise-ready trade data solutions with proven interoperability.

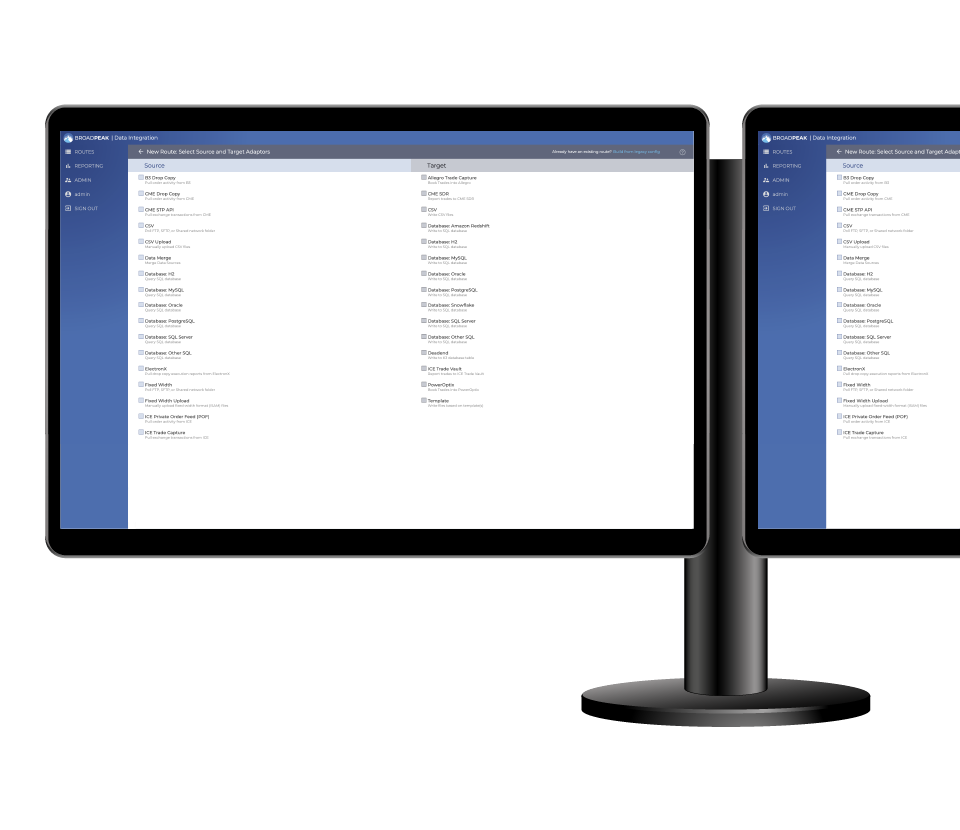

Data Integration

Tired of patchwork integrations and data silos? BroadPeak’s Data Integration solution for energy and commodity trading firms simplifies trade data flows across all systems. Certified by major global exchanges like ICE, CME, B3, and Nodal, BroadPeak ensures seamless connectivity for any tech environment.

Trade Reconciliation

Reconcile clearing broker statements with your E/CTRMs to ensure accurate trading records, avoid excess margin, and eliminate unnecessary fees. Built for energy and commodity trading firms, BroadPeak’s Trade Reconciliation solution integrates with Swap Data Repositories (SDRs) to maintain continous compliance with Dodd Frank, MiFID II, and other regulatory frameworks.

Trade Surveillance

BroadPeak’s Trade Surveillance solution for energy and commodity trading firms consolidates OTC, ETRM/CTRM, and exchange data, so you can monitor physical and financial trades in a single platform. With seamless connectivity to major exchanges and execution platforms, BroadPeak centralizes and standardizes data to streamline alerts and accelerate investigations.

Position Limits

Compliance with position limits is essential for firms trading exchange-traded derivatives, whether set by exchanges like ICE, CME, LME, or regulations such as Dodd-Frank and MiFID II. BroadPeak’s Position Limits solution for energy and commodity trading firms runs alongside its Data Integration solution, monitoring positions in real-time. Breach alerts, and actionable insights are delivered through an intuitive dashboard.

Trade Allocation

Managing trade allocations post-execution is slow and error-prone, with traders and analysts relying on back-to-back trades, manual workflows, and fragmented systems. BroadPeak’s Trade Allocation solution for energy and commodity trading firms removes inefficiencies by enabling pre-CTRM strategy allocation and automating workflows.

Regulatory Reporting

For energy and commodity trading firms BroadPeak simplifies regulatory trade reporting with pre-built adapters for leading trade repositories including ICE Trade Vault, DTCC, CME SDR, Equias, and LSEG Post-trade. BroadPeak’s Regulatory Reporting solution delivers reliable, automated reporting across multiple jurisdictions.

Trade Capture

Gain a real-time, unified view of your trading activity across all markets and venues. Built for energy and commodity trading firms, BroadPeak Trade Capture connects directly to exchanges, brokers, and internal systems to deliver clean, structured trade data to your E/CTRM, risk, and analytics platforms.

The company we keep

Clients

Perspectives

Insights

- Blog

Data and workflow across energy and commodity trading

- Whitepapers

Position limits: managing exposure across exchanges, OTC, and bilateral contracts

- News

BroadPeak Renews SOC 2 Type 2 Certification